Success Story on the use of EO to flooding monitoring

The uptake of Earth Observation based services is rather limited within the insurance sector. A recent survey by the European Association of Remote Sensing Companies (EARSC) shows that less than 1% of total revenues generated by EARSC members are from clients within the insurance and financial sector. In cooperation with major industry players (Swiss Re, Willis, Guy Carpenter, Allianz, Munich Re; the “working group”) ESA therefore decided to investigate new business models for accelerating the uptake of EO and initially focus on natural catastrophes, like flooding.

The first step was to define the industry requirements for flood information and set up a trial to test the feasibility of EO meeting these requirements. The objective of the trial is to demonstrate that EO based flood extent products can be produced during a major river flood event in Europe, supplying the insurance industry with critical information to rapidly assess exposure and potential losses.

The innovative business model adopted for the trial was to use an existing insurance industry risk data distribution platform for aggregated exposure and loss data, PERILS. PERILS is a company already well established within the insurance sector serving most major insurance and re-insurance companies. Using the PERILS platform ensures a wide exposure of the EO products to the insurance industry, since the EO based product would be provided to all PERILS clients and all other interested parties during the trial.

The Insurance working group triggered the trial on Monday June 3 following the developments of a major flood event in central Europe (mainly Germany, Czech republic and Hungary). Since then, products of the flood have been produced on an almost daily basis and made available to more than 350 registered actors in the insurance sector via the PERILS web portal.

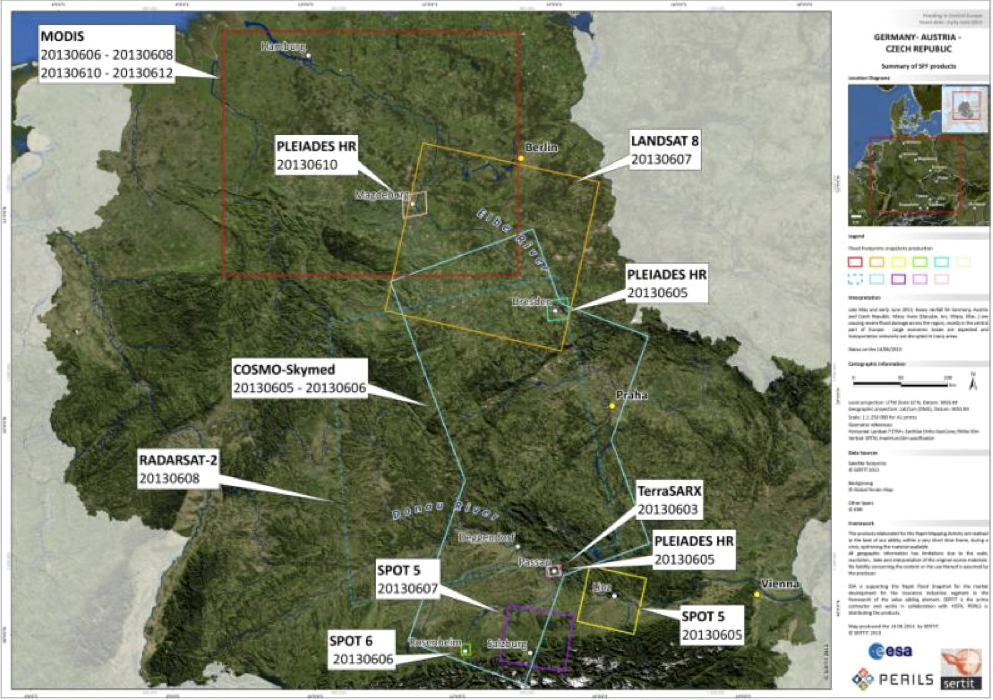

The flood event extended to several European countries. The planned coverage for ordering satellite images is shown in the image.

A wide range of satellite sensors were utilized for the trial, including Cosmo Skymed, TerraSAR X, Radarsat 2, Spot 5/6, Pleiades, MODIS and Landsat as historic reference data. The daily products provided a combination of low resolution (50-100 m) wide area coverage to higher resolution (0.5 m) products for cities. No later than 4 weeks after the flood a maximum flood extent product will be produced, a product derived from satellite observations, in-situ observations and modeling.

During the flood the use of the products within the insurance industry was mainly to continuously assess their potential losses. The maximum extent will be used for claims management and to validate and improve existing flood models within the industry.

The initial feedback from the PERILS clients is very positive, and the Insurance working group will organize a dedicated workshop to analyze the lessons learned, assess all aspects of the trial and how this new paradigm can be developed into a sustainable business.

The initial feedback from the PERILS clients is very positive, and the Insurance working group will organize a dedicated workshop to analyze the lessons learnt, assess all aspects of the trial and how this new paradigm can be developed into a sustainable business.

This page has no comments.